Betting on Progress: How Futarchy Reimagines Democratic Decision-Making

Can speculation improve policy? This blog dives into futarchy and the Meta DAO experiment – a governance experiment blending democracy and prediction markets.

Information, in its most general sense, refers to data that has been processed, organized, or structured in a way that is meaningful or useful to the person who receives it. It is what is conveyed or represented by a particular arrangement or sequence of things. In the context of communication and knowledge, information is knowledge obtained from investigation, study, or instruction. It transforms raw data into understandable entities, adding context, meaning, and utility to the basic data points.

Well, the above is the definition of information, but what does that have to do with futarchy? And why is it included in this article, let’s break it down before we engulf ourselves in Futarcy.

Information plays a crucial job in human history as information back from the medieval age helps this modern world structure governance and build wheels of a car, houses, and so much more. It helps humans learn from one peer to another peer. Information can be short-lived, time-spaned, across borders, or contained within a vessel. Well, this information is what makes futarchy possible, or at least an aspect of it called the prediction market. To fully understand futarchy, we need to understand the prediction market and the role it has to play below futarchy.

Democracy: A Vote on Values; Governance

Information plays a pivotal role in the governance of a nation, significantly influencing key indices such as GDP, health, and overall happiness. Misinterpretation or misuse of information often leads to policy decisions that bypass expert advice, leading to inefficient allocation of national resources. Such misallocations can drain national wealth, funds that could otherwise be directed towards well-conceived policies contributing to nation-building.

Democracy stands out as a preferable system of governance over monarchical rule, primarily because it allows citizens to elect their leaders through a voting process. This ensures that the populace has a say in who governs them. However, the democratic process often stops at the election of leaders, leaving little room for public input on policies thereafter. Unfortunately, this can result in implementing detrimental policies by leaders who may lack the necessary qualifications without sufficient recourse for opposition or critique from the citizenry.

Futarchy, on the other hand, maintains the foundational principles of democracy while introducing the option to bet on the outcomes of policies. These policies are represented in prediction markets, which create two or more tradable options based on potential outcomes. This mechanism allows stakeholders to determine the price of the asset (or token) based on the perceived value of the policy. Stakeholders gather information on the pros and cons of the policy through various means, such as consulting experts or running simulations. Based on this information, the price of the tradable asset is determined.

The Shadowy Side of Democratic Governance

Voter apathy

Voter apathy, characterized by a lack of interest or participation in elections, poses a significant challenge to existing democracies due to several interrelated factors:Undermines Legitimacy: Low voter turnout weakens the democratic foundation of governance. Elected officials representing a fraction of the population may struggle to claim a strong mandate for their decisions, potentially raising questions about the legitimacy of the entire system.

Disenfranchises Diverse Voices: Apathy disproportionately affects certain demographics, leading to underrepresentation of their interests and perspectives in policymaking. This can exacerbate existing inequalities and hinder progress towards a truly inclusive society.

Erosion of Accountability: When citizens disengage from the electoral process, they relinquish a crucial tool for holding elected officials accountable. This can embolden representatives to prioritize personal agendas or special interests over the broader public good, creating a system susceptible to poor governance.

Reduced Policy Efficacy: Low voter turnout can hinder the effectiveness of government policies. Lack of robust citizen engagement often translates to a disconnect between public needs and priorities, leading to policies that may be inadequately tailored or miss the mark altogether.

Discourages Civic Participation: Apathy can create a vicious cycle, discouraging further engagement from future generations. When citizens witness low participation rates, they might feel their individual vote holds little value, further perpetuating the cycle of disinterest.

Political capture

Political capture poses a significant threat to the integrity of existing democracies and governance systems for several reasons:

Erodes Public Trust: When private interests unduly influence policymaking, citizens lose faith in the system's ability to represent their collective well-being. This breeds cynicism and disengagement, undermining the foundations of democratic legitimacy.

Distorts Resource Allocation: Political capture warps economic incentives, leading to inefficient distribution of resources that benefits powerful interest groups at the expense of society as a whole. This can stifle innovation and overall economic growth.

Fosters Systemic Inequality: By rigging the rules in their favour, special interests perpetuate wealth and power disparities. This entrenched privilege prevents the creation of a truly equitable and just society.

Promotes Corruption: The lure of self-enrichment for politicians and policymakers, facilitated by powerful interest groups, creates fertile ground for corruption. This erodes the ethical framework of governance and undermines the rule of law.

In essence, political capture compromises the very purpose of democratic governance. Instead of serving the common good, systems become susceptible to exploitation by those who wield disproportionate influence, hindering progress and damaging the social fabric.

Prediction market

Well, the name gives it all. To brief this 👇

- Prediction markets allow individuals to bet on the occurrence of events and earn financial rewards if they predict correctly.

- Market prices in prediction markets reflect the perceived probability of events occurring, determined by the collective activity of traders.

- Prediction markets incentivize individuals with expertise to participate and disincentivize those without knowledge from trading, fostering more accurate predictions.

- Conditional prediction markets, like those proposed by Robin Hanson, offer insights into potential outcomes based on different policy decisions.

- Despite their potential benefits, prediction markets are subject to regulation, limitations in scope, and ethical considerations such as the potential for manipulation and the zero-sum nature of participation.

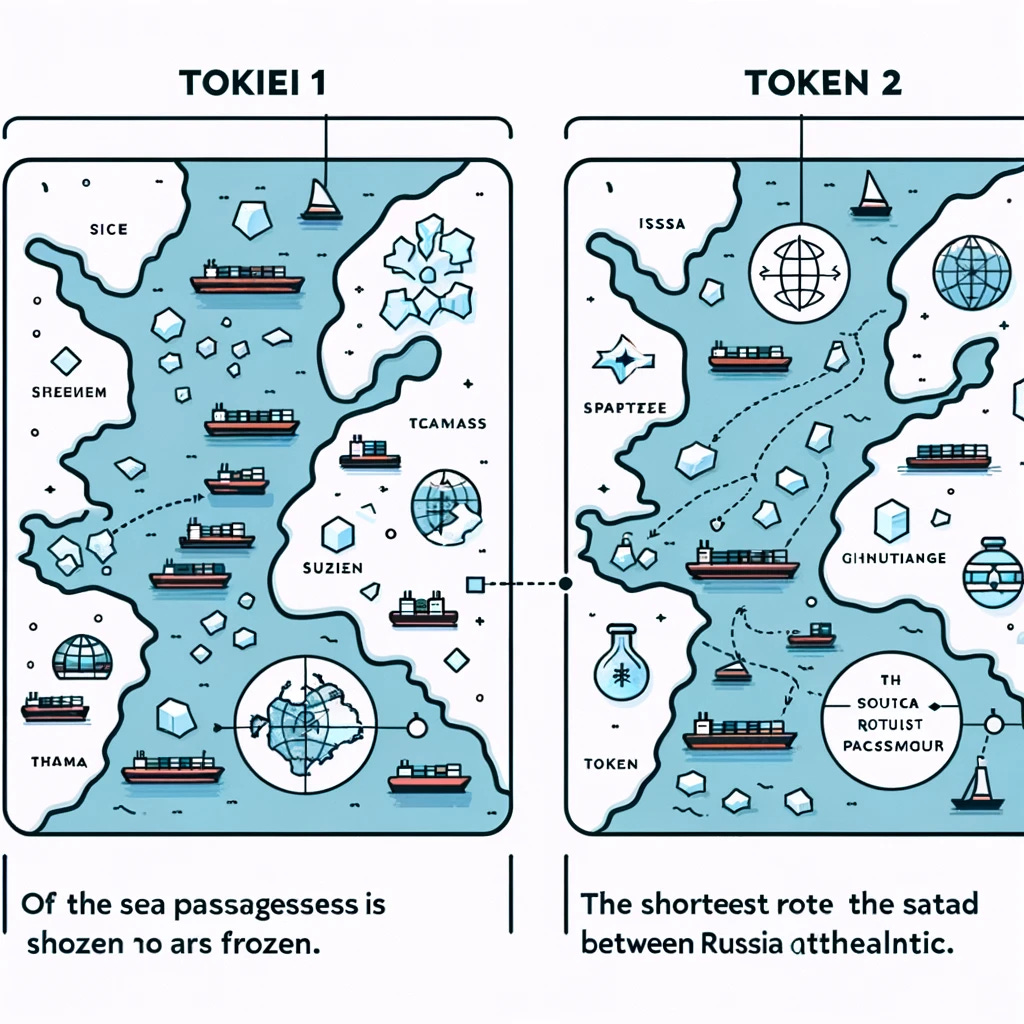

For instance, consider a ship carrying cargo that needs to be transported from the USA to China. There are two main routes: one is the fastest but poses the risk of encountering icebergs. This route goes through the sea passage off Russia and the Atlantic. The other route, while slower and more expensive, is safer and navigates through the Suez Canal.

Individuals can establish a tradable market based on two potential outcomes using two tokens: 1. The passage will be frozen, preventing the ship from navigating through it, thus necessitating the use of the Suez Canal route. 2. Conditions will allow for using the shortest route via the sea passage between Russia and the Atlantic.

Based on the expert’s information, the tokens are decided on the bets.

While various prediction market tools exist, with some utilizing money and others focusing on different forms of influence, one particular type is relevant to our discussion. Here are three types of existing prediction market platforms:-

Centralized platforms: These are dedicated websites or apps that host various prediction markets on diverse topics, like Augur or Metaculus.

Decentralized platforms: These utilize blockchain technology to facilitate peer-to-peer trading without a central authority, like Gnosis or Polymarket.

Corporate/internal markets: These are used by companies for internal decision-making, forecasting market trends, or gauging employee sentiment.

Futarchy

Futarchy proposes a more informed approach to governance by leveraging the strengths of both democracy and markets, based on three key principles:

Current democracies struggle to effectively utilize the vast amount of information available. Futarchy aims to address this by employing a more efficient system for aggregating knowledge.

Speculative markets have a proven track record as powerful tools for information aggregation. Futarchy proposes harnessing the collective knowledge of market participants to guide policy decisions.

Objective measures can be established to assess the well-being of nations. By identifying clear indicators of national prosperity and happiness, futarchy would have a basis for measuring the effectiveness of policy changes.

Working of META DAO

Meta DAO is composed of three primary Programs (aka smart contracts)

Autocrat Program

TWAP Program

Conditional_vault Program

Anyone can verify and contribute to the DAO directly here, as the programs are all Open-Source.

Any proposal created on Meta DAO has to pass through the Autocrat program (of Meta DAO). On creating a proposal, a conditional pass and a fail market (OpenBook V2 markets) are created to bet on the proposal's outcome.

Both the markets have TWAP (Time-weighted average price) oracles which are useful in providing the prices to the autocrat program.

Once the markets are live, people trade on these pass/fail markets with a USD-META token pair.

Based on the speculative outcome from the conditional markets, either one of the pass/fail conditions gets passed through, and the other trade gets reverted, as shown in the above diagram. The SVM instructions provided to the autocrat program are executed using the TWAPs.

While you may wonder how transactions can be reverted in a public blockchain, Meta-DAO solves it through the minting of conditional tokens for each market.

on providing either USDC or META to the conditional_vault program, equivalent tokens of both Pass/Fail conditional markets are minted. On finalizing, the market tokens can be redeemed back for the underlying tokens.

Here, the settling authority is the Meta-DAO itself.

The Heard Mentality Problem

While futarchy presents itself as a potentially superior form of governance, its large-scale implementation remains untested. As the first mover, Meta DAO is likely to encounter significant challenges.

Here are some challenges and problems that could arise in a futarchical environment

1. The "Beauty Contest" Problem: (also called the Keynesian beauty contest problem)

Like other market-based systems, Futarchy could be susceptible to the "beauty contest" phenomenon. Participants might prioritize predicting what others believe will happen rather than basing their choices on objective analysis and fundamental values. This could lead to herding behaviour and irrational decision-making, potentially undermining the accuracy of predicted outcomes.

Successful investing is anticipating the anticipations of others.

- John Meynard Keynes

2. Echo Chambers and Groupthink:

With prediction markets becoming the primary driver of decision-making, individuals might rely heavily on information and opinions within their existing networks. This could create echo chambers where confirmation bias reigns, hindering the consideration of diverse perspectives and leading to groupthink in decision-making.

3. Short-Term Focus vs. Long-Term Benefits:

Focusing on short-term predictions could incentivize individuals to prioritize immediate gains over long-term societal well-being. This could lead to decisions that benefit specific groups in the short run while neglecting the long-term sustainability and ethical implications for the broader community.

4. Manipulation and Market Abuse:

Malicious actors could attempt to manipulate prediction markets through misinformation campaigns, insider information, or coordinated trading strategies. This could distort market signals and lead to suboptimal decision-making based on false predictions.

5. Accessibility and Equity:

Ensuring equitable access and participation in prediction markets could be challenging. Factors like digital literacy, access to technology, and potential financial barriers could disadvantage specific groups from participating fully, undermining the collective intelligence aspect of futarchy.

These challenges highlight the need for careful design and implementation of futarchy to mitigate potential risks and ensure its effectiveness in fostering informed and responsible decision-making.

Conclusion:-

While Meta DAO is a bold and novel experiment, and its decentralized governance promises greater transparency and community ownership, including huge market participation'; its scalability and security (being a new experiment with little involvement to date) remain hurdles to overcome as it attempts to revolutionize governance.

Overall, it’s exciting to see how it develops in the future and promotes a better form of governance for the industry to move forward.

Resources:-

http://mason.gmu.edu/~rhanson/futarchy.html

https://docs.themetadao.org/

https://blog.ethereum.org/2014/08/21/introduction-futarchy

https://github.com/metaDAOproject/futarchy